Asset allocation is the process of diversifying your investments by selecting a variety of different types of investments. This may help weather the ups and downs of the financial markets because you don't depend on any one type of investment to carry the load for your investment mix. As a general rule, when investments in one asset class under-perform, investments in other classes may perform better.

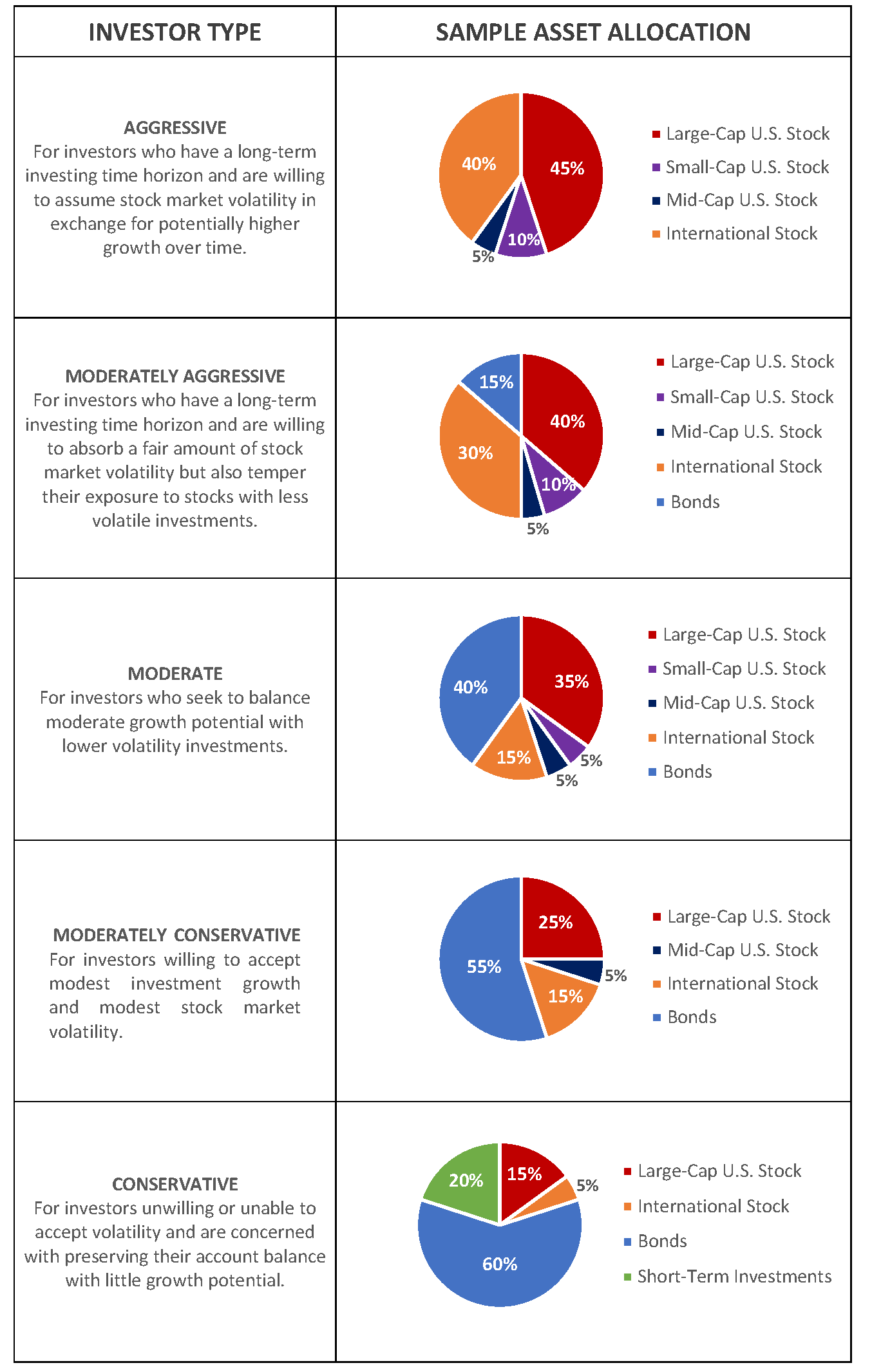

Sample asset allocation strategies based on different investor types

Now that you know more about an asset allocation strategy and the different investor types, you can choose your investments from the investment options available in the plan.

Important Note:

Though this is generally perceived to be a smart approach, asset allocation and diversification do not guarantee profits or ensure against losses in a declining market.

FOR ILLUSTRATIVE PURPOSES ONLY Intended to illustrate possible investment portfolio allocations that represent an investment strategy based on risk and return. This is not intended as financial planning or investment advice.

In applying a particular asset allocation model to your individual situation, you should consider other assets, income and investments in addition to the account you are considering for investment to the extent the model does not consider these additional assets. Investing involves risk, including possible loss of principal.