Depressed financial markets can unnerve investors and shake the foundation of their long-term investment strategies. While volatility

is an inevitable element of investing, the market has tended to reward those investors who don't get rattled during market

declines and stick to a long-term investment strategy.

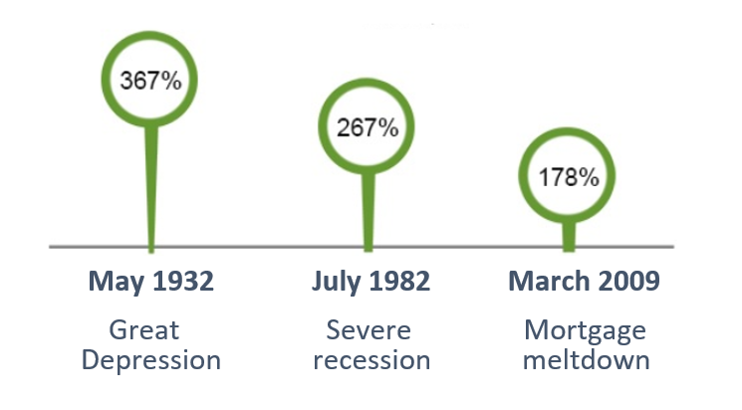

In fact, what seemed like some of the worst times to get into the stock market turned out to be the best times. It has paid to stay

invested in U.S. stocks during troubled times.

The chart illustrates the subsequent 5-year S&P 500 return after each period.

Source: Fidelity Investments. With data provided by Ibbotson, Factset, FMR Co., Fidelity Asset Allocation Research Team (AART) as of 3/31/2015

Securities offered and/or distributed by Empower Financial Services, Inc. (EFSI). Member FINRA/SIPC.

This material has been prepared for informational and educational purposes only and is not intended to provide investment, legal or tax advice.

As with any financial decision, we encourage you to discuss your options with a financial advisor and consider costs, risks, investment options, and limitations prior to investing.

You should choose the option that is right for you and your specific situation. Empower is not responsible for, has not reviewed and does not endorse the content contained on this website.