We are happy to report that the transition to our new recordkeeper, Voya Finan cial® (Voya), was successful.

cial® (Voya), was successful.

Voya, a leader in the financial services industry, is a retirement plan provider to many city, municipal, and county governments.

Most things stayed the same:

- MSRS continues as the plan administrator, which means MSRS staff will answer your calls, provide retirement information, process investment changes and withdrawal requests.

- Your current investment and account elections will remain the same.

- Your MSRS account ID will remain the same.

- You will have 24/7 online access to manage your account online; your login credentials will not change.

Some things have changed:

- Quarterly statements, confirmations, and the Account Online website (Go to Savings Plans) have a new look.

- Your MSRS login credentials did not change; however, the first time you log into your account online after June 30, 2025, you will be prompted to register your account with Voya.

- If you previously elected electronic delivery of quarterly statements and confirmations, your election did not transfer to Voya. You will need to re-elect this delivery method. See instructions below under "Your Next Steps."

- The automatic account rebalance feature did not transfer to Voya. Starting July 1, 2025, you can re-enroll in automatic account rebalance. See instructions below under "Your Next Steps."

Your next steps

Electronic delivery is a smart, secure and easy way to receive plan documents. If you previously elected e-delivery of plan documents, your election did not transfer to Voya.

What you need to do

- If you want to receive plan documents by mail, then you don't need to do anything. Future statements and plan documents will be mailed to the address we have on file for you.

- If you would like to enroll in e-delivery, follow the instructions below.

Instructions to elect paperless communications

- Login to your account online at www.mnretire.gov.

- Select Go to Savings Plans to be directed to the recordkeeper's (Voya) website.

- Select the drop down arrow next to your name (upper right corner of screen).

- Select Communication Preferences.

- Update your Paperless or Mail Options. Select the Go Paperless With One Click button to receive all of your plan documents by e-delivery. Or select Edit (right side of screen) to choose which documents to receive mail or e-delivery. You will receive an email notice when an electronic document is available to view online.

Your MSRS login credentials did not change; however, the first time you log into your account online after July 1, 2025, you will be prompted to register your account with the new recordkeeper, Voya.

- Login to your account online at www.mnretire.gov.

- Select Go to Savings Plans. You will be directed to the recordkeeper’s (Voya) website.

- Follow the prompts for Voya's account registration process. Reminder: You will only need to register your account the first time you log in starting July 1, 2025.

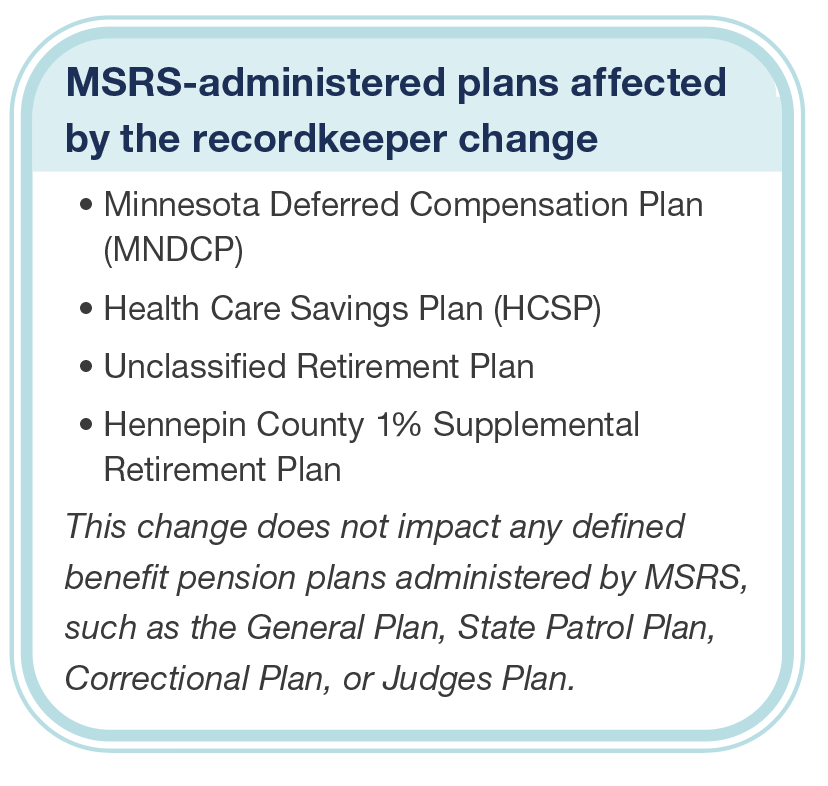

Please note: This registration process does not apply to your MSRS-administered pension plans.

Automatic account rebalance did not transfer to Voya. If you are scheduled for an automatic rebalance after June 17, 2025, you will need to re-enroll in this feature.

What you need to do

Starting July 1, 2025, you can set up a new rebalancer on your account. Review your account to determine if you would like to re-enroll in automatic account rebalance. Also, decide the frequency rebalancing should occur (quarterly, semi-annually, or annually).

There are two ways to set up a new automatic account rebalance on your account.

Online at www.mnretire.gov.

- Log into your account online

- Select Go to Savings Plans to be directed to the new recordkeeper’s (Voya) website.

- Once on Voya’s site, select Investments & Research.

- Select Manage Investments.

- Scroll down to Automatic Account Rebalance.

OR

By telephone. Contact MSRS at 651-284-7730 or 1-800-657-5757.

What is rebalancing?

Over time, shifts in the market might mean your investment selections have become 'out-of-balance' from your original election. When you choose to automatically rebalance it will help you stick to your plan even when markets swing.

What should I know about automatic account rebalance?

- A rebalancer set-up must be the same asset allocation mix and percentages that you choose for your future investment allocation of new contributions. Even if you are retired or no longer contributing to the MNDCP, your rebalancer and future allocation set-up must be the same.

- If you have automatic account rebalance established and request a fund transfer or a future allocation change, your rebalancer will automatically terminate and you will receive confirmation. Exception: If automatic account rebalance is scheduled to process on the same day as one of the noted transactions, it will not be canceled.

How you adjust your MNDCP contribution amount has changed. Starting July 1, 2025, all employees (including State of MN employees), should follow these instructions to update their MNDCP contribution. Changes can be made at anytime and as often as you like.

State of Minnesota Employees

Starting July 1, 2025, State of Minnesota employees should update and view their MNDCP contribution amount on the MSRS website. Previously, State employees changed their MNDCP contribution amount on the MMB Self Service Portal.

What you need to do

If you are satisfied with your current MNDCP contribution amount, you don't need to do anything. However, we recommend that you review your contribution amount periodically to ensure you are saving enough for retirement. A good rule of thumb is to review your contribution amount each time you receive a pay increase.

There are two ways to change your MNDCP contribution amount

Online: Login to your MSRS account online

- If this is the first time you’ve used this site, you’ll need to establish login credentials.

- Once logged in, select Go to Savings Plans to be directed to our recordkeeper’s (Voya) website.

- Select MNDCP (if you have multiple plans administered by MSRS).

- Select Contributions & Savings.

- Select Manage Contributions.

- Under Change Contributions select the Update My Contributions button.

- Under Change My Contributions, select percentage or dollar amount, then enter your contribution amount/percentage (pretax or Roth). Please confirm with your employer if they offer the Roth option.

OR

By Phone: Contact the MSRS Service Center at 651.284.7730 or 1.800.657.5757.

What else you should know

You will receive two statements to reflect the transfer of your assets.

- Voya will send a conversion notification for the period of June 25 through June 30, 2025. The notice shows the account balance transferred from Empower to Voya as of the market close on June 24, 2025.

- Empower Retirement™, the former recordkeeper, will send a statement for the period of January 1 through June 24, 2025. This statement will show your account activity including the transfer to Voya. The statement will show an ending account balance of $0. Don’t be alarmed by the $0 balance -- it simply means your account assets moved to Voya.

The MSRS website URL will change to www.mnretire.gov. You may continue to use the existing URL, www.msrs.state.mn.us, for the near future, but if you have bookmarked this web address, we recommend that you change it to www.mnretire.gov.

Voya, a leader in the financial services industry, is a retirement recordkeeper to many state, municipal, and county governments.

A recordkeeper provides:

- Investment accounting services

- Access to a participant website that allows you to view your account information and process transactions

- Other functions needed to operate a retirement plan.

MSRS will continue to administer your plans. As the administrator, MSRS will:

- Answer your calls.

- Provide counseling and education regarding your retirement.

- Process investment and withdrawal requests.

- Process HCSP reimbursement requests.